Fiscal Policy

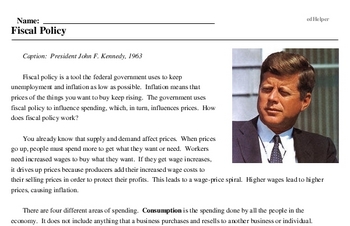

Caption: President John F. Kennedy, 1963

Fiscal policy is a tool the federal government uses to keep unemployment and inflation as low as possible. Inflation means that prices of the things you want to buy keep rising. The government uses fiscal policy to influence spending, which, in turn, influences prices. How does fiscal policy work?

You already know that supply and demand affect prices. When prices go up, people must spend more to get what they want or need. Workers need increased wages to buy what they want. If they get wage increases, it drives up prices because producers add their increased wage costs to their selling prices in order to protect their profits. This leads to a wage-price spiral. Higher wages lead to higher prices, causing inflation.

There are four different areas of spending. Consumption is the spending done by all the people in the economy. It does not include anything that a business purchases and resells to another business or individual. When you buy a loaf of bread at the store, the amount you spend is part of our nation's consumption for the year. That amount gets added to the GDP. When a miller buys wheat from a farmer, a baker buys flour from a miller, or a store buys bread from a baker, these purchases are not part of consumption and do not get added to the GDP.

Investment is what businesses produce but do not sell to people. Investment includes the value of buildings, machinery, and things on store shelves at the end of the year that have not been sold. Buildings and machinery are capital resources. They can be used over and over to make more products. Things on store shelves that have not been sold are the business's inventory.

Government spending is the money that all governments-federal, state, and local-spend to pay employees and to buy things for their own use like paper clips, fire engines, and military weapons.

A net export is the difference between the dollar amounts of imported and exported goods. Almost every year since 1983, the United States has bought more goods from businesses in foreign countries than it has sold to foreign countries. When imports are bigger than exports, the GDP is reduced. No country likes to import more than it exports for very long. The balance of trade is referred to as a trade surplus when more goods are exported than imported or as a trade deficit or trade gap when there are more imports than exports.

One thing that affects the balance of trade is the exchange rates of the monies involved. If the dollar is strong, the U.S. can buy more goods abroad for its money. If the dollar is weak against other currencies, fewer goods can be bought for the same amount of money.

The federal government uses fiscal policy-the way it taxes citizens and businesses and the way it spends money-to influence consumption, investment, and net exports. For example, the more money people have, the more they will be able to spend. So the government can influence consumption by changing the amount of money people have to spend. If people have more money, the government cannot force people to spend it, but they will usually spend at least part of it.